I will be taking a slightly different approach on personal finance, especially a part that is neglected when discussing personal finance which for me is the top line and must be in a growth spectrum for any effective result to happen.

My cue is taken from accounting in business which is simply building /funding a good personal balance sheet whilst ensuring good income from your profit and loss account. Your income is your revenue less expenses while the balance sheet is used to determine your net worth i.e. Asset – Liability in simple terms. Assets is what you own and Liability is what you owe. Two things hold true here, for you to earn an income that can be ploughed back into your balance sheet to improve your net worth, there must be revenue. In this instance your salaries, earnings from side gigs /hustles and sales revenue for the entrepreneurs.

The other point is your expenses must be checked in such a way it does not erode the revenue, so that you’ve got enough income to plough back to your balance sheet per my illustration above. Here is the catch, the more you increase your revenue, the better your chances in this journey and the more you live within and sometimes below your means the better your chances also. Therefore, as much as you can, you need to focus on these 2 top lines of your personal finance in order to be able to get into the various types of investments.

Learn to earn

Start always by seeking avenues to increase your primary revenue.This may take some sacrifices e.g. a higher degree, a side hustle, a promotion, a career switch, job switch, a start-up business, a certification etc.

Live within your means

As simple as it sounds, it can sometimes be difficult due to need to let people know that you have made it. Especially, if it was a long time coming, but this is wise ( smiles).

Pay yourself first

This simply means pay yourself a portion of your income every month. This is not only good for the final investment you will achieve with the fund. It is also therapeutic . See it as a form of self-care.

Embrace borrowing only for safe, proven investments

As much as you can, stay away from borrowing to acquire cars, designer clothes etc. These items should be funded with cash as much as possible. The only exception to this rule is, if such acquisitions will yield you profitable returns on your primary revenue.

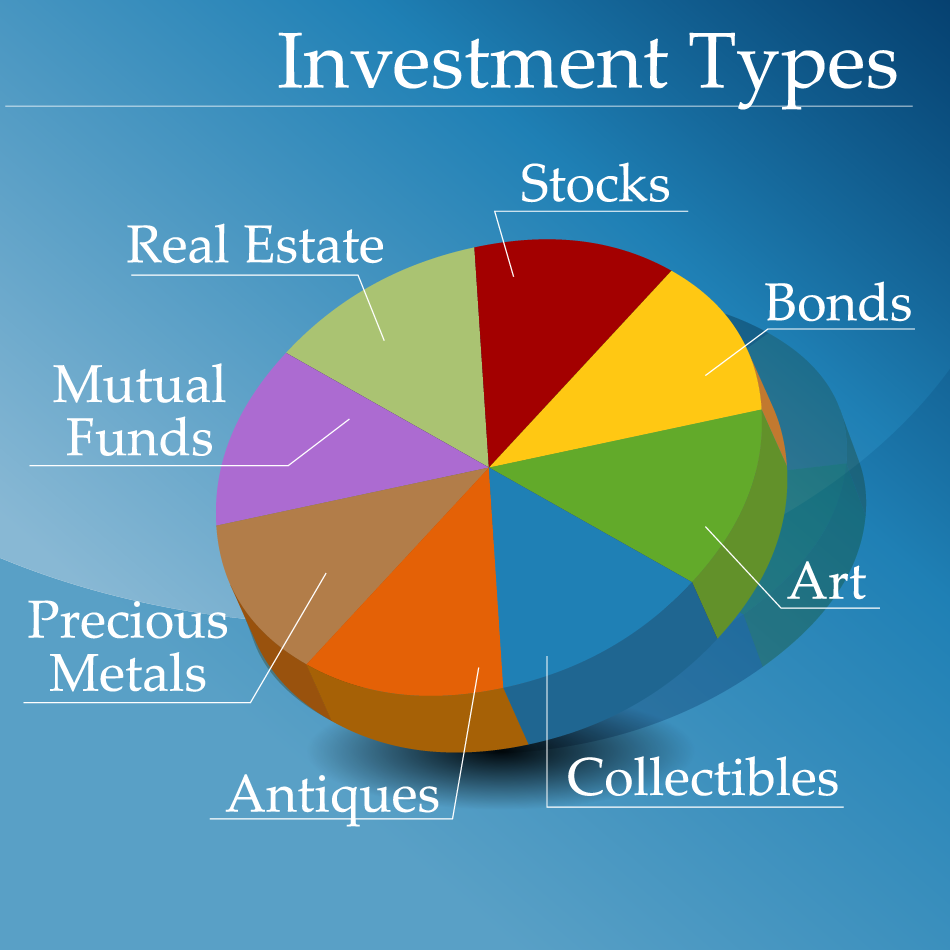

Put your money to work

This can be achieved by putting large earned sums or savings discussed above into profitable investments.

HAPPY INVESTING

Leave a comment