Just a few weeks after our Legacy Ledger spotlight on the 1929 Stock Market Crash and our cheeky little peekaboo into the Nigerian Stock Market’s sudden bull run e asked the million-dollar question: Can this excitement really last?

A recent Financial Times article reminded us that most bull markets are fueled by the notorious three L’s: Leverage, Liquidity, and Lunacy. Time and again, this trio has proven to be the life of the (financial) party: easy credit, excess cash, and overconfident investors all dancing together until the music stops. And in a market as volatile and jittery as Nigeria’s, it often takes just one small political jab to rattle the system and send the whole pyramid wobbling.

The Crumble

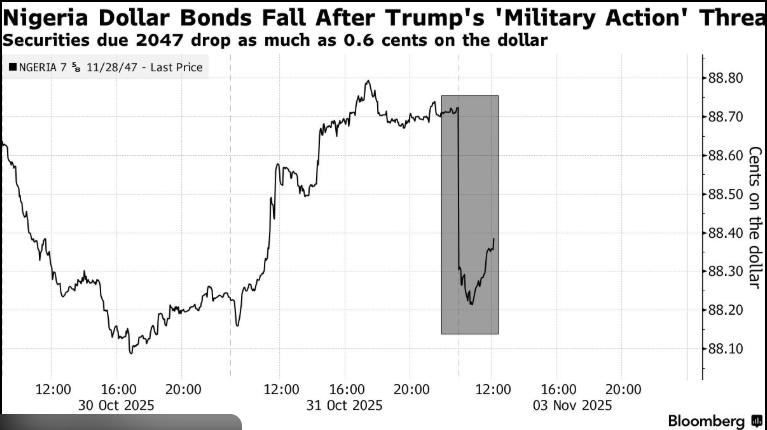

And just like that, the cookie crumbled last week after President Trump’s designation of Nigeria as a “country of particular concern.” The aftermath? A staggering ₦2.8 trillion wiped off the stock exchange in a flurry of panic sales. Investor confidence took a nosedive, shaken by the heightened political uncertainty. Other markets equally reacted swiftly. The fixed income and the foreign exchange market both tumbled suffering some mild shocks and depreciation in value amid foreign capital outflows and dollar scarcity.

This brings us right back to our blockbuster post in 2021, “The 7 Must-Knows of Investing,” where we emphasized the importance of understanding a country’s political climate and economic framework before diving in. It’s not that other markets are immune to such shocks, but the real question is-what buffers or potential interventions does each country have when political or systemic risks like this begin to crystallize?

Diversification and Timing

This episode also drives home a timeless truth in investing-never put all your eggs in one basket. Diversification isn’t just a fancy term; it’s a survival strategy. Spreading investments across industries, markets, and products helps cushion the blow when one sector or market takes a hit.

The lesson here goes beyond just understanding political or country risk. It’s also about the power of proactiveness – knowing when to act, whether in trading or in choosing a broker. After all, the flipside of Nigeria’s high-risk environment is its equally high potential for returns. The old saying still holds: the higher the risk, the higher the reward.

For the bold and aggressive investor, timing is everything. Sometimes, you need to make that quick call rather than wait for the bandwagon-because if you wait too long, the music might stop before you get to dance.

Happy investing, and happy holidays!

In need of a proactive trader or broker? We can advise, contact us at Flo Capital

#flocapital #investing #investorsconfidence #stockmarkets #countryrisk #politicalrisk #knowyourcountry #7mustknowsofinvesting

Leave a comment